Vauxhall Company Car Tax Calculator

Vauxhall company car tax calculator is an essential tool for businesses and individuals alike, providing a simple and accurate way to determine the company car tax payable on your vehicle? Accurate calculations: The calculator provides an accurate estimate of the company car tax payable on your vehicle, ensuring you're not paying too much or too little tax? The Vauxhall company car tax calculator is an essential tool for businesses and individuals alike, providing a simple and accurate way to determine the company car tax payable on your vehicle

Vauxhall Company Car Tax Calculator: A Comprehensive Guide

As a company car driver, understanding the tax implications of your vehicle can be crucial in making informed decisions about your fleet. Vauxhall company car tax calculator is an essential tool for businesses and individuals alike, providing a simple and accurate way to determine the company car tax payable on your vehicle.

What is Company Car Tax?

Company car tax is a tax on the benefit-in-kind (BIK) that your employer receives from providing a company car to you. This tax is calculated based on the car's value, its CO2 emissions, and the employee's tax band. The tax is typically paid by the employee, but the employer may also be responsible for paying a small proportion of the tax.

How Does the Vauxhall Company Car Tax Calculator Work?

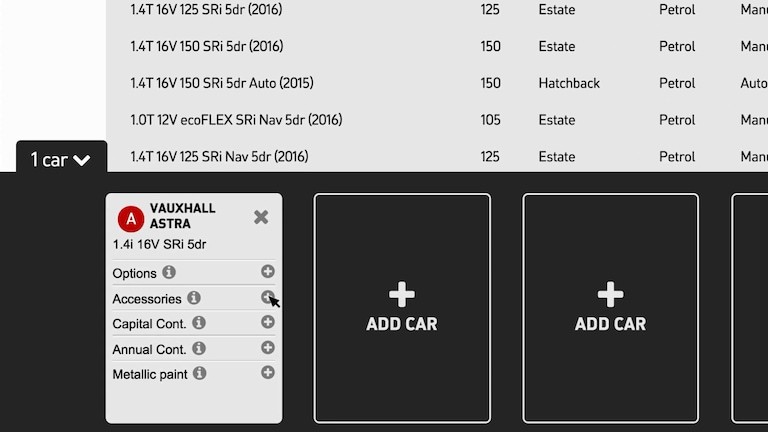

The Vauxhall company car tax calculator is an online tool that takes into account the following factors to calculate the company car tax:

- Vehicle details: The calculator requires you to enter the Vauxhall car's make, model, and registration year to determine its CO2 emissions and P11D value (a tax-related value of the vehicle).

- Employee details: You need to provide your tax band (20%, 40%, or 45%) and the percentage of your weekly mileage that is business-related.

- Mileage details: The calculator asks for the annual mileage and the percentage of your annual mileage that is business-related.

- Emissions and fuel type: The calculator takes into account the car's CO2 emissions, mpg (miles per gallon), and fuel type (petrol, diesel, or electric).

Using these factors, the calculator provides an estimated company car tax for the vehicle, taking into account the tax rates and allowances for the current tax year.

Benefits of Using the Vauxhall Company Car Tax Calculator

Using the Vauxhall company car tax calculator offers several benefits, including:

- Accurate calculations: The calculator provides an accurate estimate of the company car tax payable on your vehicle, ensuring you're not paying too much or too little tax.

- Easy to use: The online tool is user-friendly and simple to navigate, making it easy to calculate company car tax even for non-accounting professionals.

- Up-to-date information: The calculator uses the latest tax rates and allowances, ensuring your calculations are always accurate and up-to-date.

- Compliance: Using the Vauxhall company car tax calculator helps ensure your company is compliant with HMRC regulations and pays the correct amount of tax.

Frequently Asked Questions

Here are some frequently asked questions about the Vauxhall company car tax calculator:

- Q: Do I need to register for a Vauxhall account to use the calculator? A: No, you can use the calculator without creating a Vauxhall account.

- Q: Is the calculator only available for Vauxhall cars? A: Yes, the calculator is specifically designed for Vauxhall cars, but you can use other online tools for other makes and models.

- Q: Can I use the calculator for multiple cars? A: Yes, you can use the calculator for multiple cars by entering each vehicle's details separately.

- Q: Will the calculator give me an accurate estimate of the company car tax? A: Yes, the calculator uses the latest tax rates and allowances to provide an accurate estimate of the company car tax.

Conclusion

The Vauxhall company car tax calculator is an essential tool for businesses and individuals alike, providing a simple and accurate way to determine the company car tax payable on your vehicle. By understanding the tax implications of your vehicle, you can make informed decisions about your fleet and ensure compliance with HMRC regulations.

Sadean Areas