Acura Finance Rates: What You Need to Know

Acura finance rates are determined by a combination of factors, including your credit score, loan term, and the car's MSRP. Credit Score: Your credit score plays a significant role in determining your Acura finance rate. Take advantage of our current finance rate offers and work with a certified Acura dealership to get behind the wheel of your new car.

Acura Finance Rates: A Comprehensive Guide to Financing Your Dream Car

When shopping for a new car, many factors come into play, from the model and trim level to the color and features. However, financing is a crucial aspect that cannot be ignored. At Acura, we understand the importance of finding the right financing options to suit your needs and budget. In this guide, we'll take a closer look at Acura finance rates, exploring the factors that influence them and how you can get the best deal.

Understanding Acura Finance Rates

Acura finance rates are determined by a combination of factors, including your credit score, loan term, and the car's MSRP. The interest rate you qualify for will have a significant impact on the total cost of ownership, making it essential to understand what contributes to your rate.

Factors that Influence Acura Finance Rates

- Credit Score: Your credit score plays a significant role in determining your Acura finance rate. A higher credit score (720+ FICO) can qualify you for better interest rates, while a lower score (below 620) may result in higher rates.

- Loan Term: The longer the loan term, the higher the interest rate. A 60-month loan, for example, will typically have a higher rate than a 36-month loan.

- MSRP: The car's Manufacturer's Suggested Retail Price (MSRP) also affects the finance rate. More expensive models may have higher finance rates due to their higher value.

- Down Payment: A down payment can reduce the amount financed and, subsequently, the interest rate.

- Trade-In: If you're trading in a vehicle, the value of the trade-in can also impact your finance rate.

Acura Finance Rate Offers

At Acura, we offer competitive finance rates to help you get behind the wheel of your new car. Here are some examples of current Acura finance rate offers:

- 90-Day Payment Breakdown: Take advantage of a 90-day payment breakdown, with no payment due for 90 days. This offer is available on select models, and rates start at 2.9% APR.

- 0% Financing: Qualified buyers can take advantage of 0% financing on select models, which translates to significantly lower monthly payments.

- Low-Rate Financing: Acura offers low-rate financing options on select models, with rates starting at 3.9% APR.

How to Get the Best Acura Finance Rate

To secure the best Acura finance rate, follow these tips:

- Check Your Credit Score: Before applying for financing, review your credit report and check your credit score. Work on improving your credit score if necessary.

- Research and Compare Rates: Research and compare rates from different lenders, including Acura and other car manufacturers.

- Make a Down Payment: Consider making a down payment to reduce the amount financed and, subsequently, the interest rate.

- Trade-In: If you're trading in a vehicle, make sure to get an appraisal to accurately value the trade-in.

- Work with a Certified Acura Dealership: Our certified Acura dealerships can help you navigate the financing process and provide personalized recommendations to get the best rate.

Conclusion

Acura finance rates play a significant role in the overall ownership experience. By understanding the factors that influence your rate and taking steps to improve your credit score, make a down payment, and trade-in your vehicle, you can secure a competitive rate. Take advantage of our current finance rate offers and work with a certified Acura dealership to get behind the wheel of your new car.

H2: Frequently Asked Questions

- What is the minimum credit score required for Acura finance? The minimum credit score required for Acura finance is typically 620 FICO. However, this may vary depending on the loan terms and borrower qualifications.

- Can I negotiate Acura finance rates? Yes, you can negotiate Acura finance rates with your certified Acura dealership. They may be able to offer better rates or incentives based on your credit score and other factors.

- What is the difference between a 36-month and 60-month loan? A longer loan term, such as 60 months, will typically have a higher interest rate than a shorter loan term, such as 36 months. This is because the lender is taking on more risk by lending for a longer period.

H3: Additional Resources

- Acura Finance Calculator: Use our online finance calculator to estimate your monthly payments and explore different financing options.

- Acura Finance FAQs: Refer to our comprehensive FAQ section for answers to common questions about Acura finance.

-

Contact Us: Reach out to your local Acura dealership or our customer service team for personalized assistance with financing your new car.

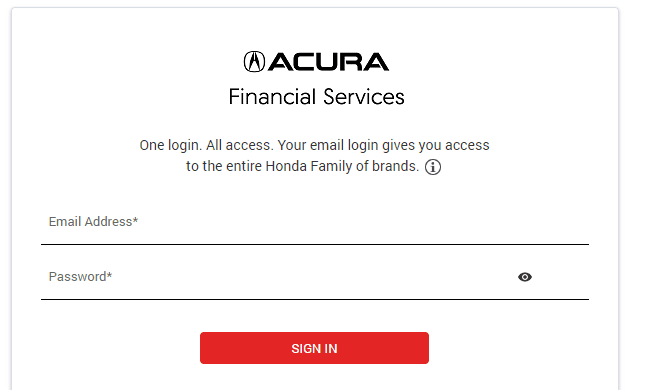

Acura Finance Rates - Welcome to be able to my own weblog, on this period We'll show you with regards to Acura Finance Rates. And after this, this can be the initial photograph.

Why don't you consider graphic preceding? can be of which wonderful???. if you think so, I'l l demonstrate several impression yet again underneath :

So, if you would like have the magnificent shots regarding (Acura Finance Rates), just click save icon to save these graphics in your personal pc. They're all set for down load, if you like and wish to take it, click save button on the page, and it'll be immediately saved in your home computer. As a final point if you would like have unique and latest image related with (Acura Finance Rates), please follow us on google plus or bookmark this page, we try our best to offer you regular up-date with fresh and new images. Hope you like staying right here. For many up-dates and recent news about (Acura Finance Rates) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with upgrade periodically with all new and fresh pictures, enjoy your surfing, and find the perfect for you.

Here you are at our blogs, content above (Acura Finance Rates) published by diana. Nowadays we are excited to announce that we have found an incredibly interesting topic to be discussed, that is (Acura Finance Rates) Many individuals attempting to find details about(Acura Finance Rates) and definitely one of these is you, is not it?